ETH Price Prediction: Can Ethereum Reach $10,000 in July 2025?

#ETH

- Technical Strength: ETH's price is above key moving averages, with bullish MACD and Bollinger Band signals.

- Institutional Adoption: Major players like SharpLink Gaming and Trump-linked ventures are accumulating ETH, signaling confidence.

- Regulatory Tailwinds: BlackRock's Ethereum ETF filing and regulatory clarity are driving positive sentiment.

ETH Price Prediction

ETH Technical Analysis: Bullish Signals Emerge

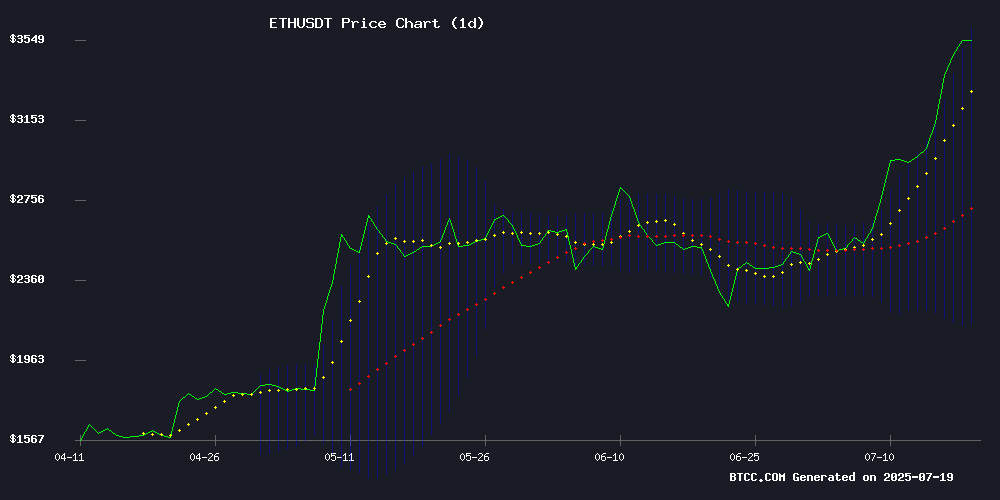

According to BTCC financial analyst William, ethereum (ETH) is currently trading at $3,522.20, significantly above its 20-day moving average (MA) of $2,873.34, indicating strong upward momentum. The MACD indicator shows a bullish crossover with values at -416.80 (MACD line), -274.06 (signal line), and -142.74 (histogram). Bollinger Bands suggest potential volatility, with the upper band at $3,606.21 and the lower band at $2,140.48. William notes that ETH's price is testing the upper Bollinger Band, which could signal a continuation of the uptrend if the price remains above the middle band ($2,873.34).

Ethereum Market Sentiment: Institutional Confidence Grows

BTCC financial analyst William highlights that Ethereum's rally is being fueled by institutional demand, as evidenced by SharpLink Gaming's $5 billion ETH holdings and a Trump-linked venture amassing $251 million in ETH. The S&P 500's record high and regulatory breakthroughs for crypto stocks are further boosting market sentiment. William points out that Ethereum's breakout above key resistance levels and BlackRock's filing for a staked Ethereum ETF are driving bullish predictions, with some analysts targeting $4,000 in the near term and $10,000 by July 2025.

Factors Influencing ETH’s Price

Ethereum's Rally Fueled by Derivatives Market as Spot Demand Lags

Ethereum's price surge past $3,600 this week masks a critical divergence between derivatives activity and organic demand. The 20% weekly gain appears driven by Leveraged futures positions rather than sustained spot buying, raising sustainability concerns.

CryptoQuant data reveals yellow-hot zones on Ethereum's futures volume map, signaling overheated speculation. Analysts question whether spot traders will follow the derivatives-led momentum or leave the rally vulnerable to liquidation cascades.

S&P 500 Hits Record High as Crypto Stocks Surge on Regulatory Breakthrough

The S&P 500 closed at another all-time high, fueled by a rally in crypto-related stocks following the signing of the GENIUS Act into law. The Nasdaq Composite ROSE 0.75% to 20,885.65, marking its tenth record this year, while the Dow Jones added 229.71 points to 44,484.49. All three major indexes reached intraday highs during the session.

President Trump's GENIUS Act, the first comprehensive crypto regulation in U.S. history, sparked a sharp uptick in crypto equities. Coinbase, Robinhood, and Bitmine Immersion led the charge, with Coinbase briefly surpassing its IPO debut price. "This isn't just another policy shift—it's the foundation for crypto's institutional future," said Noelle Acheson, author of Crypto is Macro Now. The legislation cements digital asset oversight into federal law, making future reversals politically untenable as stablecoins become entrenched in global finance.

Ether outperformed among major cryptocurrencies as the regulatory clarity triggered broad crypto market gains. The White House ceremony attracted bipartisan lawmakers and industry leaders, signaling rare consensus on digital asset policy. Market participants now anticipate accelerated institutional participation, with exchange-traded products and traditional finance vehicles likely to follow.

DeFi Sector Reclaims 2022 Highs as Ethereum Leads Market Recovery

The decentralized finance (DeFi) sector has surged past its 2022 valuation thresholds, with Ethereum spearheading the rally. Analysts at Kobeissi describe the movement as one of the largest short squeezes in cryptocurrency history, pushing ETH toward all-time highs.

Total value locked (TVL) in DeFi protocols has rebounded dramatically after a brutal 2022 that saw $3.6 billion lost to hacks and ecosystem collapses like FTX and Terra Luna. Lending activity shows particular strength, with open borrows exceeding $19 billion and Ethereum-based loans peaking at $22.6–$24 billion this year—supported by over $35 billion in collateral.

Market maturity, decentralized exchange adoption, and liquid staking innovations underpin the recovery. Macroeconomic tailwinds from anticipated US rate cuts further buoy sentiment across crypto markets.

Trump-Linked Crypto Venture Amasses $251M Ethereum Stash with $26M Unrealized Profit

World Liberty Financial (WLF), the Trump family's flagship cryptocurrency venture, has aggressively expanded its ethereum holdings, now controlling 70,143 ETH worth $251 million. The firm's latest purchase of 861 ETH for $3 million on July 18 follows a strategic accumulation pattern that began in late 2024.

On-chain data reveals WLF spent $214.9 million acquiring 66,275 ETH between November 2024 and March 2025 at an average price of $3,243. The buying spree intensified this month with three separate purchases totaling 3,923 ETH, capitalizing on Ethereum's 8.5% daily surge to $3,629.

The position currently shows $26 million in paper profits, representing a 22.2% weekly gain for ETH. The asset has rallied 43% monthly and 126% quarterly, cementing its position as the second-largest cryptocurrency by market capitalization.

SharpLink Gaming Boosts Ethereum Holdings to $5 Billion, Signaling Institutional Confidence

Ethereum's bullish momentum continues as it stabilizes above $2,600, with SharpLink Gaming making a landmark move to expand its ETH treasury strategy. The Nasdaq-listed firm amended its SEC filing to increase its stock sale authorization from $1 billion to $5 billion, explicitly earmarking proceeds for Ethereum accumulation.

This positions SharpLink as the largest corporate holder of ETH—a watershed moment for institutional crypto adoption. The announcement coincides with Ethereum's market dominance, where it leads altcoins in both price recovery and trading volume. Network fundamentals now align with growing corporate interest, suggesting a potential supply squeeze if this trend accelerates.

SharpLink's $115M ETH Accumulation Signals Institutional Demand Surge

Ethereum markets are flashing bullish signals as institutional players aggressively accumulate ETH. SharpLink purchased 32,892 ETH ($115M) this week, bringing its nine-day total to 144,501 ETH ($515M). This buying spree coincides with a rare Coinbase premium emerging, where ETH trades higher on the U.S. exchange than global platforms like Binance.

The premium suggests American whales and institutions are positioning ahead of potential catalysts. Historical patterns show such premiums often precede major announcements or ETF developments. On-chain data reveals accelerating demand through U.S.-based platforms, with Coinbase leading the charge.

Ethereum Targets $4,000 After Breaking Key Resistance Level

Ethereum's recent surge above the 50-day Exponential Moving Average (EMA50) has reignited bullish sentiment, with analysts projecting a rally toward $4,000. The breakout follows weeks of resistance, marked by multiple failed attempts to flip the EMA50 into support.

The cryptocurrency has surged 28.17% in a week, climbing from $2,500 to $3,226, signaling a potential shift in momentum. Analyst Doctor Profit notes the clean break and hold above the moving average as a technical confirmation of further upside.

Ethereum Price Prediction: Can ETH Reach $10K in July 2025, As BlackRock Files For Staked Ethereum ETF?

Ethereum's price surged 4% in the past 24 hours, reaching $3,614 amid a bullish week for the altcoin. ETH has climbed 20% over seven days and 43% in the past month, fueled by $5.5 billion in inflows into Ethereum ETFs since their debut last summer. BlackRock's recent filing to add staking to its Ethereum ETF signals growing institutional demand, with iShares following suit.

SharpLink Gaming bolstered Ethereum's momentum by adding $115 million to its holdings, now totaling 353,000 ETH—the largest corporate stash. ETF inflows continue to skyrocket, reinforcing ETH's strong fundamentals and long-term bullish outlook. The $10K price target by July 2025 appears increasingly plausible as institutional adoption accelerates.

How High Will ETH Price Go?

Based on technical and fundamental analysis, BTCC financial analyst William predicts that Ethereum (ETH) could reach $4,000 in the near term, with a potential long-term target of $10,000 by July 2025. Key factors supporting this outlook include:

| Factor | Impact |

|---|---|

| Technical Indicators | Bullish MACD crossover, price above 20-day MA |

| Institutional Demand | SharpLink Gaming's $5B ETH holdings, Trump-linked $251M ETH stash |

| Market Sentiment | Regulatory breakthroughs, BlackRock's Ethereum ETF filing |

| Price Targets | $4,000 (near-term), $10,000 (July 2025) |